Warren Buffett a eu 93 ans. Déjà ça c’est gagner à la loterie comme il dirait. Mais en plus faire 20% en moyenne par an sur une telle longévité en bourse. C’est exceptionnel.

Alors pour souhaiter un joyeux anniversaire à Warren Buffett. Voici 93 de ses citations les plus importantes et quelques doublons.

En gras, celles qui me semblent vraiment les plus importantes à prendre comme des conseils intemporels et comme la quintessence de ce que Warren nous aura transmis de plus riche pour les prochaines décennies à venir.

Voici ce qui est pour moi , la meilleure collection de citations de Warren Buffett pour résumer toute sa pensée.

En gras les plus importantes pour moi.

- Rule No. 1 is never lose money. Rule No. 2 is never forget Rule No. 1.

- Diversification is a protection against ignorance. It makes very little sense for those who know what they’re doing.

- Do not take yearly results too seriously. Instead, focus on four or five-year averages.

- All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies.

- American business – and consequently a basket of stocks – is virtually certain to be worth far more in the years ahead.

- An investor should act as though he had a lifetime decision card with just twenty punches on it.

- And so the important thing we do with managers, generally, is to find the .400 hitters and then not tell them how to swing.

- The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.

- Bitcoin has no unique value at all.

- Buy a stock the way you would buy a house. Understand and like it such that you’d be content to own it in the absence of any market.

- The years ahead will occasionally deliver major market declines – even panics – that will affect virtually all stocks. No one can tell you when these traumas will occur.

- I insist on a lot of time being spent, almost every day, to just sit and think. That is very uncommon in American business.

- Buy companies with strong histories of profitability and with a dominant business franchise.

- For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments.

- I believe in giving my kids enough so they can do anything, but not so much that they can do nothing.

- The world went mad. What we learn from history is that people don’t learn from history.

- The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.

- Among the various propositions offered to you, if you invested in a very low cost index fund – where you don’t put the money in at one time, but average in over 10 years – you’ll do better than 90% of people who start investing at the same time.

- Because if you’re wrong and rates go to 2 percent, which I don’t think they will, you pay it off. It’s a one-way renegotiation. It is an incredibly attractive instrument for the homeowner and you’ve got a one-way bet.

- Cash is to a business as oxygen is to an individual: never thought about when it is present, the only thing in mind when it is absent.

- Don’t get caught up with what other people are doing. Being a contrarian isn’t the key but being a crowd follower isn’t either. You need to detach yourself emotionally.

- For 240 years it’s been a terrible mistake to bet against America, and now is no time to start.

- I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.

- I have no views as to where it (gold) will be, but the one thing I can tell you is it won’t do anything between now and then except look at you. Whereas, you know, Coca-Cola will be making money, and I think Wells Fargo will be making a lot of money, and there will be a lot — and it’s a lot — it’s a lot better to have a goose that keeps laying eggs than a goose that just sits there and eats insurance and storage and a few things like that.

- I just sit in my office and read all day.

- I won’t say if my candidate doesn’t win, and probably half the time they haven’t, I’m going to take my ball and go home

- If returns are going to be 7 or 8 percent and you’re paying 1 percent for fees, that makes an enormous difference in how much money you’re going to have in retirement.

- We want products where people feel like kissing you instead of slapping you.

- If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.

- The most important investment you can make is one in yourself.

- If you buy things you do not need, soon you will have to sell things you need.

- If you don’t feel comfortable making a rough estimate of the asset’s future earnings, just forget it and move on.

- If you like spending six to eight hours per week working on investments, do it. If you don’t, then dollar-cost average into index funds.

- If you’re in the luckiest 1% of humanity, you owe it to the rest of humanity to think about the other 99%.

- If you’re smart, you’re going to make a lot of money without borrowing.

- In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.

- In the 54 years (Charlie Munger and I) have worked together, we have never forgone an attractive purchase because of the macro or political environment, or the views of other people. In fact, these subjects never come up when we make decisions

- In the business world, the rearview mirror is always clearer than the windshield.

- Investors should remember that excitement and expenses are their enemies.

- It is a terrible mistake for investors with long-term horizons to measure their investment ‘risk’ by their portfolio’s ratio of bonds to stocks.

- It is not necessary to do extraordinary things to get extraordinary results.

- It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.

- The one thing I will tell you is the worst investment you can have is cash. Everybody is talking about cash being king and all that sort of thing. Cash is going to become worth less over time. But good businesses are going to become worth more over time.

- It’s been an ideal period for investors: A climate of fear is their best friend. Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance.

- It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.

- It’s better to have a partial interest in the Hope diamond than to own all of a rhinestone.

- It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

- Just pick a broad index like the S&P 500. Don’t put your money in all at once; do it over a period of time.

- Keep things simple and don’t swing for the fences. When promised quick profits, respond with a quick « no”.

- Lose money for the firm, and I will be understanding. Lose a shred of reputation for the firm, and I will be ruthless.

- Many management teams are just deciding they’re gonna buy X billions over X months. That’s no way to buy things. You buy when selling for less than they are worth. … It’s not a complicated equation to figure out whether it is beneficial or not to repurchase shares.

- The difference between successful people and really successful people is that really successful people say no to almost everything.

- Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can’t buy what is popular and do well.

- Never invest in a business you cannot understand.

- Your premium brand had better be delivering something special, or it’s not going to get the business.

- One can best prepare themselves for the economic future by investing in your own education. If you study hard and learn at a young age, you will be in the best circumstances to secure your future.

- The most important thing to do if you find yourself in a hole is to stop digging.

- One thing that could help would be to write down the reason you are buying a stock before your purchase. Write down « I am buying Microsoft at $300 billion because… » Force yourself to write this down. It clarifies your mind and discipline.

- Only when the tide goes out do you discover who’s been swimming naked.

- Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.

- Price is what you pay. Value is what you get.

- Read 500 pages like this every day. That’s how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it.

- Risk comes from not knowing what you’re doing.

- If a business does well, the stock eventually follows.

- Since I know of no way to reliably predict market movements, I recommend that you purchase Berkshire shares only if you expect to hold them for at least five years. Those who seek short-term profits should look elsewhere.

- Someone’s sitting in the shade today because someone planted a tree a long time ago

- The best thing that happens to us is when a great company gets into temporary trouble… We want to buy them when they’re on the operating table.

- Speculation is most dangerous when it looks easiest.

- Stay away from it. It’s a mirage, basically…The idea that it has some huge intrinsic value is a joke in my view.

- The best chance to deploy capital is when things are going down.

- The stock market is a no-called-strike game. You don’t have to swing at everything — you can wait for your pitch.

- There is nothing wrong with a ‘know nothing’ investor who realizes it. The problem is when you are a ‘know nothing’ investor but you think you know something.

- This does not bother Charlie and me. Indeed, we enjoy such price declines if we have funds available to increase our positions.

- Too-big-to-fail is not a fallback position at Berkshire. Instead, we will always arrange our affairs so that any requirements for cash we may conceivably have will be dwarfed by our own liquidity.

- There are all kinds of businesses that Charlie and I don’t understand, but that doesn’t cause us to stay up at night. It just means we go on to the next one, and that’s what the individual investor should do.

- You can’t buy what is popular and do well.

- We never want to count on the kindness of strangers in order to meet tomorrow’s obligations. When forced to choose, I will not trade even a night’s sleep for the chance of extra profits.

- We will reject interesting opportunities rather than over-leverage our balance sheet.

- We’ve long felt that the only value of stock forecasters is to make fortune tellers look good. Even now, Charlie and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.

- What is smart at one price is stupid at another.

- What we learn from history is that people don’t learn from history.

- When stock can be bought below a business’s value it is probably the best use of cash.

- When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients.

- When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.

- When you have able managers of high character running businesses about which they are passionate, you can have a dozen or more reporting to you and still have time for an afternoon nap. Conversely, if you have even one person reporting to you who is deceitful, inept or uninterested, you will find yourself with more than you can handle.

- Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.

- Widespread fear is your friend as an investor because it serves up bargain purchases.

- You are neither right nor wrong because the crowd disagrees with you. You are right because your data and reasoning are right.

- You can’t borrow money at 18 or 20 percent and come out ahead.

- You can’t produce a baby in one month by getting nine women pregnant.

- The most important quality for an investor is temperament, not intellect… You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.

- You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ. You only have to be able to evaluate companies within your circle of competence.

- The size of your circle of competence is not very important; knowing its boundaries, however, is vital.

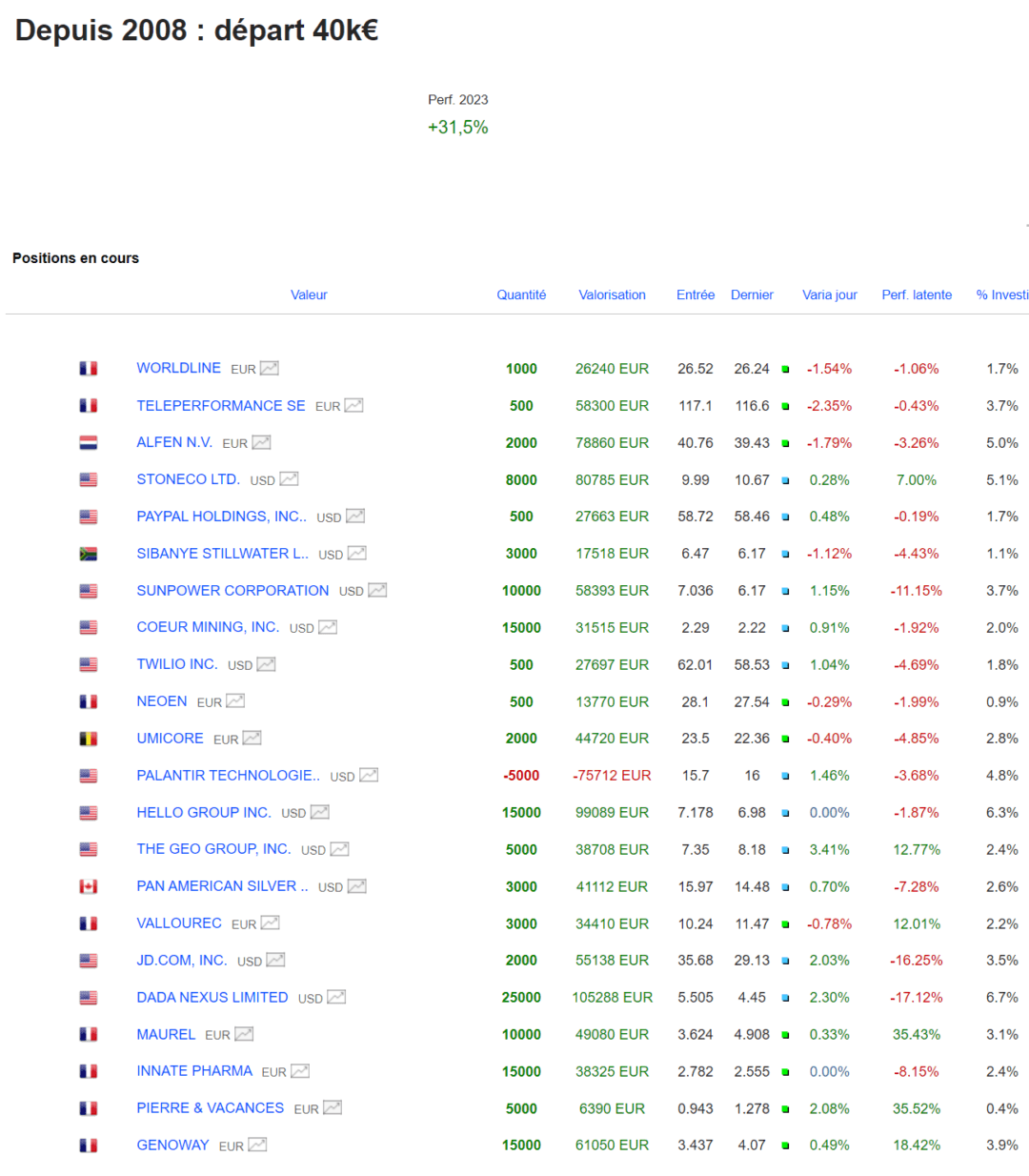

Portefeuille Graphseo Bourse

Toujours en mode attente et pas loin de faire un nettoyage si les indices boursiers confirment que nous n’avions là qu’un simple rebond technique et qu’il va falloir construire.

J’ai pris quelques lignes sur des valeurs en tendance baissières et mal aimées car si on doit construire un socle nous y sommes; Donc l’invalidation est proche et réduit le risque de grosse perte. on saura couper assez rapidement si cela ne part pas dans le bon sens.

On semble parti pour toujours pas mal de zig zag. Et je conserve donc au-delà du trading court terme, pas mal de liquidités.

Les lecteurs de cet article lisent maintenant :

amicalement

Julien

Ne loupez plus une seule opportunité pour investir à moindre risque en recevant la newsletter de Graphseo bourse

PS: Tous mes investissements sont partagés en temps réel sur L'Académie des Graphs. Le portefeuille représente mes convictions personnelles consolidées (de mes différents courtiers) et n'est pas une incitation à l'achat ni à la vente. La performance en cours inclus les gains ou moins values latentes et l'impact du change sur les actions étrangères. Performance 2025: +145%; 2024: +41%; 2023: +38%; 2022: +46%; 2021: +122%; 2020: +121%; 2019: +79%; 2018: +21%; 2017: +24%; 2016: +12%; 2015: +45%; 2014: +30%; 2013:+72%, 2012:+9%, 2011:-11%... Clique-ici pour découvrir l'Académie des Graphs où je t'accompagne au quotidien, partage mes positions et portefeuilles dynamique et long terme en temps réel.